Motor Vehicle Use Tax Return . if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to hmrc using form p87. if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. If you use a company car for private use. you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses. for tax purposes, there are two approaches:

from www.templateroller.com

you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. for tax purposes, there are two approaches: use a simpler calculation to work out income tax for your vehicle, home and business premises expenses. If you use a company car for private use. if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to hmrc using form p87.

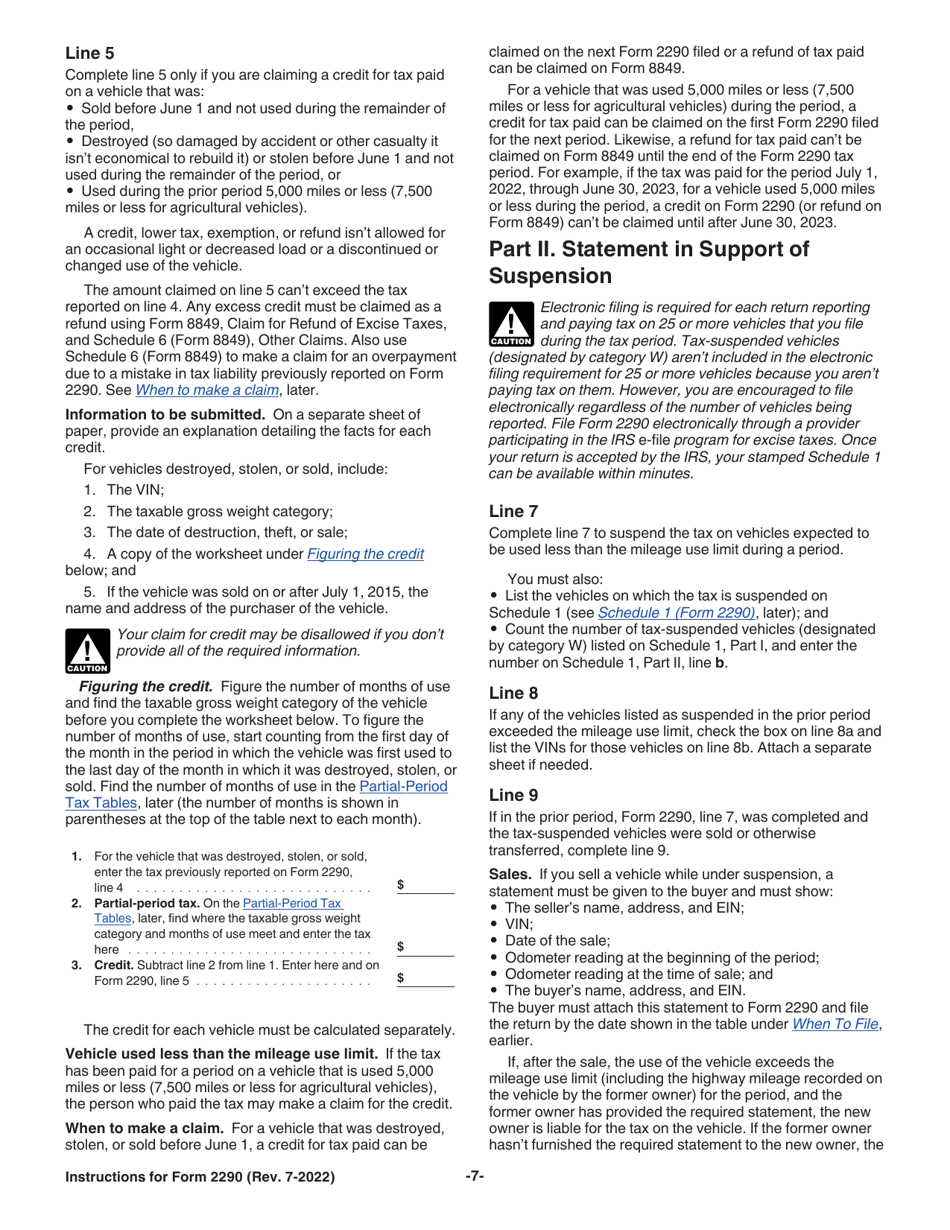

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax

Motor Vehicle Use Tax Return if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses. as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. If you use a company car for private use. if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to hmrc using form p87. for tax purposes, there are two approaches:

From www.formsbank.com

Form 8400 Individual Use Tax Return For Motor Vehicle Purchases Motor Vehicle Use Tax Return If you use a company car for private use. if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. use a simpler calculation to work out income tax for your vehicle, home. Motor Vehicle Use Tax Return.

From www.templateroller.com

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax Motor Vehicle Use Tax Return if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to hmrc using form p87. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses. If you use a company car for private use. as a. Motor Vehicle Use Tax Return.

From www.templateroller.com

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax Motor Vehicle Use Tax Return if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. If you use a company car for private use. use a simpler calculation to work out income tax for your vehicle, home. Motor Vehicle Use Tax Return.

From www.pinterest.com

Information about Form 2290, Heavy Highway Vehicle Use Tax Return Motor Vehicle Use Tax Return use a simpler calculation to work out income tax for your vehicle, home and business premises expenses. If you use a company car for private use. for tax purposes, there are two approaches: if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim. Motor Vehicle Use Tax Return.

From www.pdffiller.com

Fillable Online Motor Vehicle Use Tax Fax Email Print pdfFiller Motor Vehicle Use Tax Return you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to hmrc using form p87. If you use a company car. Motor Vehicle Use Tax Return.

From tfx.tax

Comprehensive Guide to Heavy Highway Vehicle Use Tax TFX US Expat Motor Vehicle Use Tax Return use a simpler calculation to work out income tax for your vehicle, home and business premises expenses. you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. for tax purposes, there are two approaches: if you don’t have to file a tax return,. Motor Vehicle Use Tax Return.

From www.templateroller.com

Sample Form RUT50 Fill Out, Sign Online and Download Printable PDF Motor Vehicle Use Tax Return if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. If you use a company car for private use. you may be able to calculate your car, van or motorcycle expenses using. Motor Vehicle Use Tax Return.

From www.formsbank.com

Form 8400 Individual Use Tax Return For Motor Vehicle Purchases Motor Vehicle Use Tax Return if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. use. Motor Vehicle Use Tax Return.

From www.templateroller.com

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax Motor Vehicle Use Tax Return for tax purposes, there are two approaches: you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to hmrc using. Motor Vehicle Use Tax Return.

From www.formsbirds.com

Heavy Highway Vehicle Use Tax Return Free Download Motor Vehicle Use Tax Return you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. If you use a company car for private use. use a simpler calculation to. Motor Vehicle Use Tax Return.

From www.trucktax.com

EFile Your Truck Tax Form 2290 Highway Heavy Vehicle Use Tax Motor Vehicle Use Tax Return use a simpler calculation to work out income tax for your vehicle, home and business premises expenses. as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. for tax purposes, there are two approaches: if you're a sole trader or a partner, and also use the. Motor Vehicle Use Tax Return.

From www.pdffiller.com

Fillable Online Reminder Heavy highway vehicle use tax return (Form Motor Vehicle Use Tax Return as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to hmrc using form p87. If you use a company car for private use.. Motor Vehicle Use Tax Return.

From blanker.org

IRS Form 2290. Heavy Highway Vehicle Use Tax Return Forms Docs 2023 Motor Vehicle Use Tax Return as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. you. Motor Vehicle Use Tax Return.

From www.templateroller.com

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax Motor Vehicle Use Tax Return as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses. if you're a sole trader or a partner, and also use the car for personal use, you'll need to work. Motor Vehicle Use Tax Return.

From www.templateroller.com

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax Motor Vehicle Use Tax Return you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to hmrc using form p87. as a business owner, you. Motor Vehicle Use Tax Return.

From www.templateroller.com

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax Motor Vehicle Use Tax Return for tax purposes, there are two approaches: If you use a company car for private use. if you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to hmrc using form p87. as a business owner, you can claim a tax deduction for expenses. Motor Vehicle Use Tax Return.

From www.templateroller.com

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax Motor Vehicle Use Tax Return as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. if you're a sole trader or a partner, and also use the car for personal use, you'll need to work out what you can claim based on how much you spend to use the vehicle for. you. Motor Vehicle Use Tax Return.

From www.pdffiller.com

Fillable Online Form 2290 (Rev. July 1998). Heavy Vehicle Use Tax Motor Vehicle Use Tax Return for tax purposes, there are two approaches: use a simpler calculation to work out income tax for your vehicle, home and business premises expenses. as a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. you may be able to calculate your car, van or motorcycle expenses. Motor Vehicle Use Tax Return.